Understanding UAN (Universal Account number) and its effect on PF Withdrawal / Transfer

Universal PF Account number has become a reality now, thanks to the untiring efforts of EPFO, India. A unique Universal Account number (UAN) has already been allotted to all contributory members of EPFO and its services are expected to become operational from October 16, 2014. Right now EPFO is in the process of integrating KYC details with the UAN of each employee.

You might have already heard about this new system from your employer or from your friends and might be thinking how will it benefit you. To answer that, lets understand first what is UAN.

What is the purpose of UAN (Universal Account number)

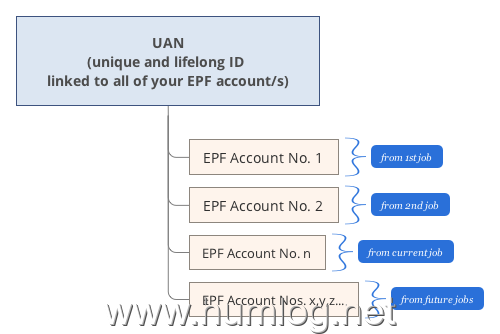

UAN is a unique number which will remain associated with an employee throughout his career. It will be portable across companies and can be used anywhere in India. On changing jobs, the employee will still get a new PF account number from the new employer but it will get linked to this unique UAN. Thus, UAN will be like an umbrella for the multiple PF accounts allotted to an employee by different employers.

Before the introduction of UAN system, employees had to depend on their employers to verify and clear the PF withdrawal form. In many cases, employers had misused this dependence - they would keep the withdrawal forms pending, they would threaten the employees that if they leave the company they wont get their PF withdrawal forms signed, etc. To end these dependency problems and to facilitate centralization of employee data, EPFO has introduced UAN.

By introducing UAN, EPFO will also be able to track job changes of every employee. On a job change, the employee is required to provide his UAN to the new employer who will in turn link the new PF account to this UAN. Thus, EPFO will have information on where a person is employed at any given time. This will also prevent people to make EPF withdrawals on job change.

What are the benefits of UAN to an employee

-

EPF Transfer and EPF Withdrawal will take lesser time.

-

No need to depend on employer to forward the claims for EPF Transfer and EPF Withdrawal. They can be submitted online easily.

-

Details of all the PF accounts can be viewed at one place.

-

There will be transparency in PF account/s. EPFO will send a monthly SMS intimation of PF amount.

-

(In Future) Employees need not apply for transfer of PF accumulations on changing jobs. The procedure for the same is yet to be launched by the EPFO.

How to start using UAN

To start using UAN, you will need to use UAN Member Portal. Below are steps to login and activate your account:

-

Check whether you have been allotted a UAN - Click on Know your UAN Status and enter your EPF number.

-

Contact your employer to obtain your UAN (if you have been allotted one)

-

Activate your UAN - Click on Activate Your UAN and enter your UAN, Mobile no. and EPF number.

-

Login to UAN portal - using the password created while activating the UAN.

That's it, start using various facilities given through UAN -

-

Link Previous Member IDs (PF account numbers)

-

Enter KYC Details

-

Check eligibility for online transfer claim

-

Download e-Passbook

-

Download UAN Card

-

Edit personal details

- More services are likely to be added in future.

FAQs:

-

Will I still need to transfer the old PF account while changing jobs or will it get merged automatically?

Ans:- In the initial phase of UAN, you would still need to transfer the old account. Though, the process would be lot more convenient as it can be done easily online on UAN portal. However, In future, employees need not apply for transfer of PF accumulations on changing jobs. -

How will UAN helps in PF transfer/withdrawal process?

Ans:- As there will be no need of employee verification anymore (because of KYC details seeded with UAN), you will not have to approach the previous employer for EPF transfer/withdrawal. You can directly apply online. -

Can I update/upload my KYC document through member portal?

Ans:- Yes, you can do so. Your uploaded KYC document has to be digitally approved by employer, till then status of KYC will be shown as “Pending”. -

What is to be done in case I change the job and join somewhere else?

Ans:- You need to simply declare your UAN to your subsequent employers. -

What is the helpline number of UAN?

Ans:- Helpline numbers: 1800-118-005 (toll-free) or 0471-2449545.

News on EPF UAN

New UAN Member Portal launched in Dec, 2016

EPFO launched a new portal for UAN called Unified Portal in December, 2016. As of 3rd January, 2017 new unified EPF Member Portal is facing problems and is mostly down. EPFO has said that they are working on the problem and the site will be up very soon.