Understanding Premium Calculation on Auto Insurance

Last week when it was time for the renewal of my car's insurance, I was getting quotes from many insurers but was not sure which one to pick. So to educate myself I went through various resources on motor insurance renewal. Here I am putting details on the same for your quick understanding.

First and foremost, motor insurance is compulsory - Vehicles are insured for the first year usually at the time of buying and they need to be renewed thereafter. The insurance policy covers damages to third parties which means the beneficiary of the policy is someone other than the two parties involved in the contract (the car owner and the insurance company). The third party will be the person who may have been injured by you and who claims damages against you. In addition to the mandatory third party cover, it is prudent to cover loss or damages to the vehicle itself by way of Comprehensive/Package policy, which covers both “Liability” (i.e. the mandatory third party liability) as well as “Own damage” to the insured vehicle.

Because the premiums for identical policies vary widely among different car insurance companies, it is good to choose an insurer which offers the best-value proposition. New India Assurance, United India Insurance, Oriental Insuarance Company, ICICI Lombard, Bajaj Allianz, Tata AIG, HDFC Ergo and Royal Sundaram are among the insurers which offer motor insurance. Most companies offer online premium quotes too. You can switch your car insurance to another company, if you are not satisfied with your current insurer.

Calculation of Premium:

As described above, Package policy has two components: the "Own Damage Premium" and the "Liability Premium". The Own Damage component of premium is computed on the basis of below factors:

IDV –Insured Declared Value of the vehicle is the maximum amount that you can claim to compensate for any loss arising from theft or accident. It is an important variable affecting the premium amount greatly. IDV is calculated on the basis of car's ex-showroom price. While renewing the insurance, the IDV will be adjusted for any depreciation it has undergone over the time. The depreciation chart from IRDA for arriving at IDV is shown below:

| AGE OF THE VEHICLE | % OF DEPRECIATION FOR FIXING IDV |

|---|---|

| Not exceeding 6 months | 5% |

| Exceeding 6 months but not exceeding 1 year | 15% |

| Exceeding 1 year but not exceeding 2 years | 20% |

| Exceeding 2 years but not exceeding 3 years | 30% |

| Exceeding 3 years but not exceeding 4 years | 40% |

| Exceeding 4 years but not exceeding 5 years | 50% |

The IDV of vehicles aged over 5 years is calculated by mutual agreement between insurer and the insured. Instead of depreciation, IDV of old cars is arrived at by assessment of vehicle’s condition done by surveyors, car dealers etc.

The Own Damage premium depends solely on IDV and is around 2-3% of the IDV depending on the age and cubic capacity of the vehicle. So a lesser value of IDV would attract lesser premium and vice versa. It is highly recommended to get an IDV which is near to the market value of car. Some insurers decrease the value of IDV to decreases the premium amount but it will give you a lower coverage. A higher IDV, on the other hand, does not ensure a higher cover (inspite of paying higher premiums) because the insurance company, at the time of settlement, pays you in accordance with their own depreciation chart and not by your IDV.

NCB - No Claim Bonus is the next important variable which affects the premium amount. You are entitled for a NCB discount if you have not made a claim in the previous year. The biggest advantage is that NCB gets accumulated over the years so if you are a good driver you can avail a discount of as much as 50%. However, you lose this advantage as soon as you make a claim. So avoid making claims when the claim amount is lower than your premium. The NCB discount chart from IRDA for arriving at NCB discount value is shown below:

| All Types of Vehicles | % OF Discount on Own Damage Premium |

|---|---|

| No claim made or pending during the preceding full year of insurance | 20% |

| No claim made or pending during the preceding 2 consecutive years of insurance | 25% |

| No claim made or pending during the preceding 3 consecutive years of insurance | 35% |

| No claim made or pending during the preceding 4 consecutive years of insurance | 45% |

| No claim made or pending during the preceding 5 consecutive years of insurance | 50% |

NCB can be transferred from an old vehicle to a new one as it gets accumulated for the driver, not the vehicle. In case of change of insurer also, the NCB can be transferred to the new insurer by producing the proof of the NCB.

Discounts - In addition to NCB, there are some additional discounts available under Own Damage Premium. Installation of anti-theft devices, membership of Automobile Association of India, opting for voluntary deductible/excess are some of the categories of discounts. Voluntary deductible/excess means the amount that will be borne by you in a claim settlement. For example, an excess of Rs 1000 would mean that you pay Rs 1000 of the claim amount, while the company pays the rest. There are two types of excesses. First one is compulsory which depends upon the C.C. (cubic capacity) of the vehicle and which cannot be removed from insurance policy. The second is a voluntary excess, which, when availed, reduces the premium of the policy. However, this also means that when a loss occurs, you will have to pay a large portion of the claim amount out of your own pocket. Taking a voluntary deductible is generally not recommended but if you are confident of your driving ability, you can opt for it to save on premium.

Loadings Any electrical and electronic items fitted to the vehicle but not included in the manufacturer's selling price of the vehicle are insured at an extra charge resulting an increase in the premium amount. The same is true for the CNG/ LPG systems.

All the above factors influence the "Own Damage Premium" only. The "Liability" component of premium is fixed (by the insurance regulator IRDA based upon the cubic capacity of the vehicle) and the rates may change every year.

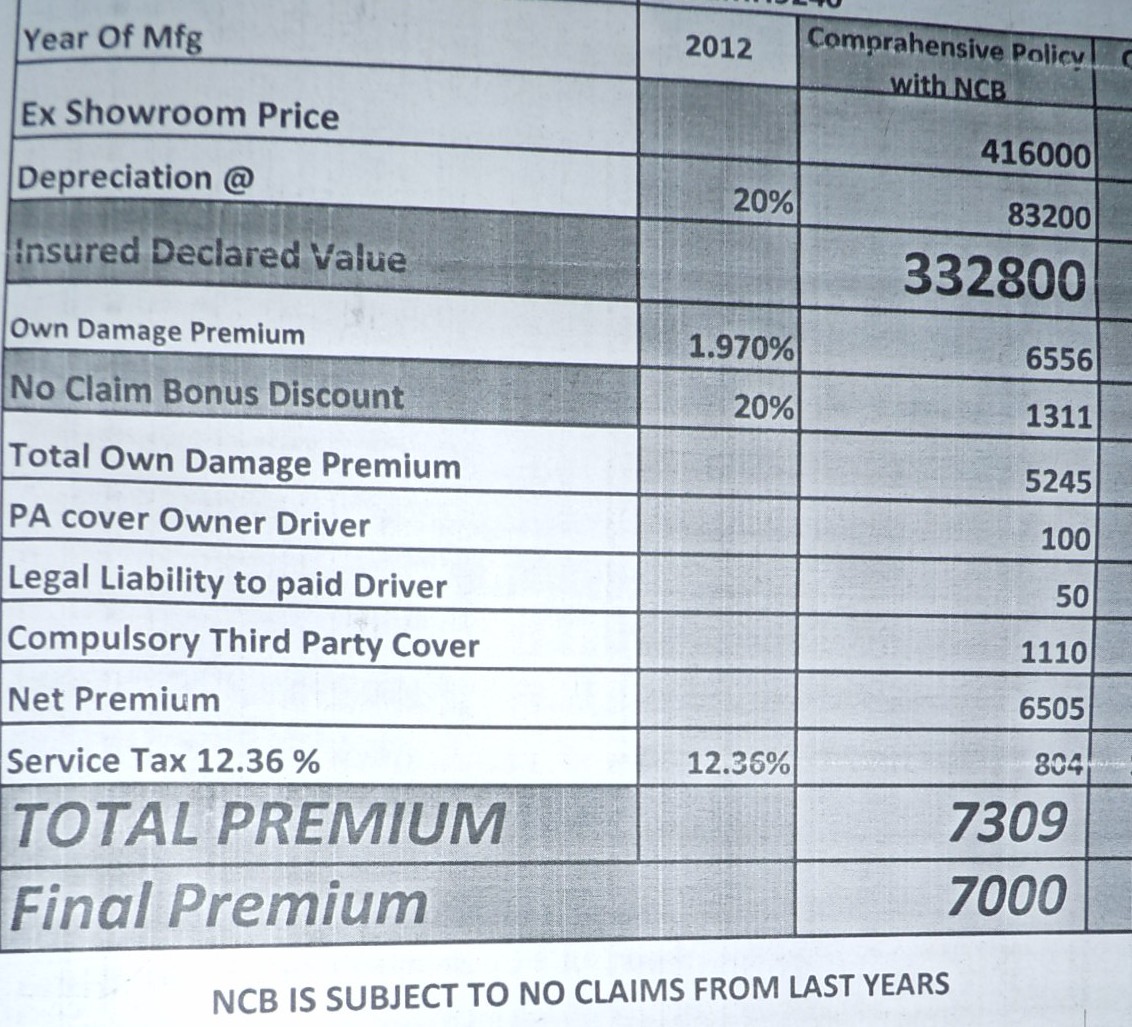

Sample Calculation:

Hope this information will help you in making a judicious decision when renewing your insurance policy.

Further Reads: