PF withdrawal process - Form 19 (EPF) & Form 10C (EPS)

When I applied for withdrawal of PF/EPF from my last company, it took me some time to understand the process. To make it easy for you, here are the step-by-step instructions for PF withdrawal.

Documents required to submit to your last employer for EPF withdrawal

-

Form 19 (for EPF withdrawal)

-

Form 10c (for EPS withdrawal)

-

A blank cancelled cheque (this is required to ensure that account number and IFS Code are clearly visibly). The cheque should be of you as a single account holder and not a joint account cheque.

Update 1: In July 2012, EPFO has declared that it will accept joint bank account only if the bank account is maintained with the spouse. Link to EPFO Circular

Update 2: In December 2015, EPFO has issued new UAN based withdrawal claim form 'Form-19 (UAN)'

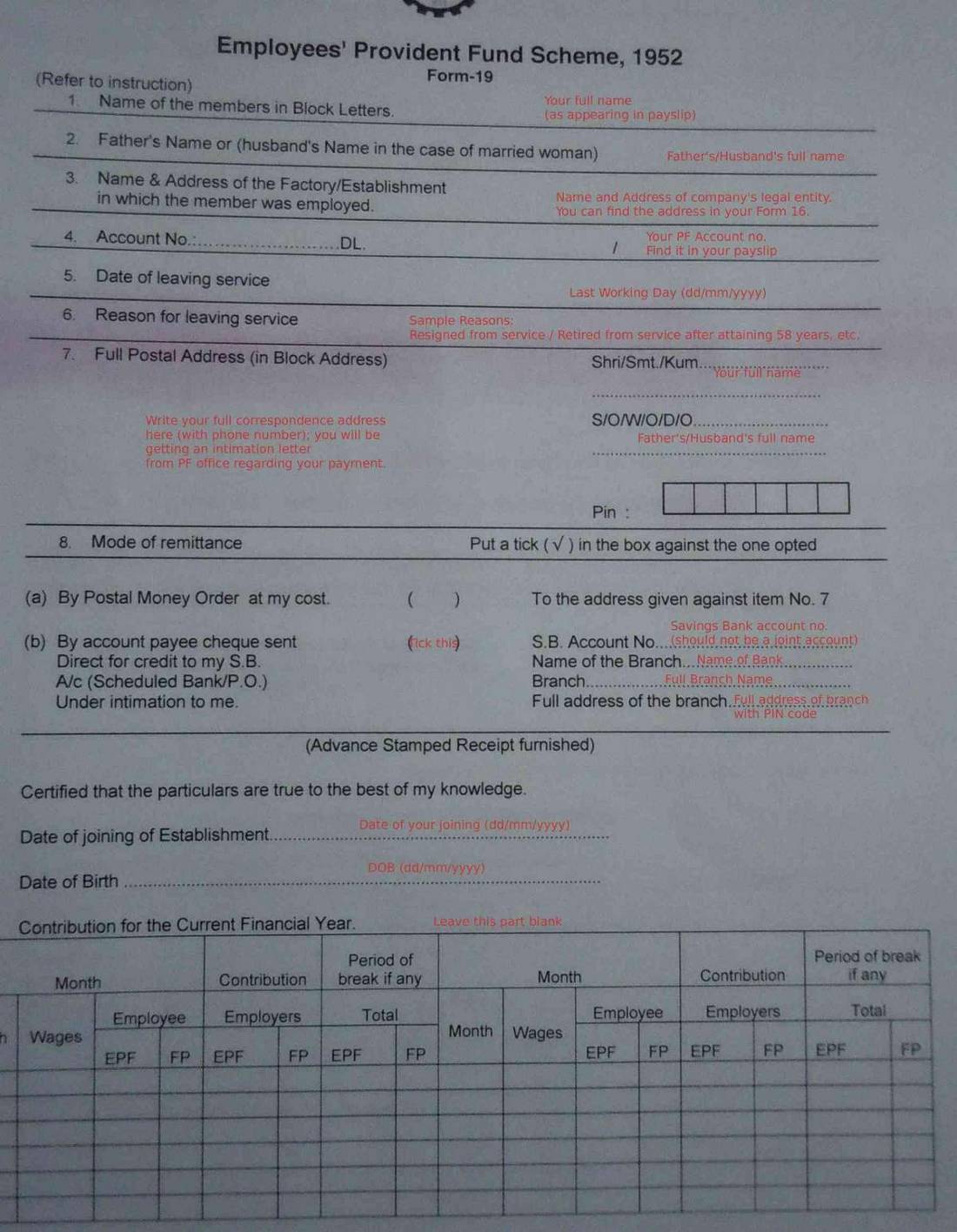

Instructions on how to fill Form 19

I have put instructions in red against all the rows that need to be filled. Right click and open the below images in a new tab and then click for zoom.

Form 19 Page 1

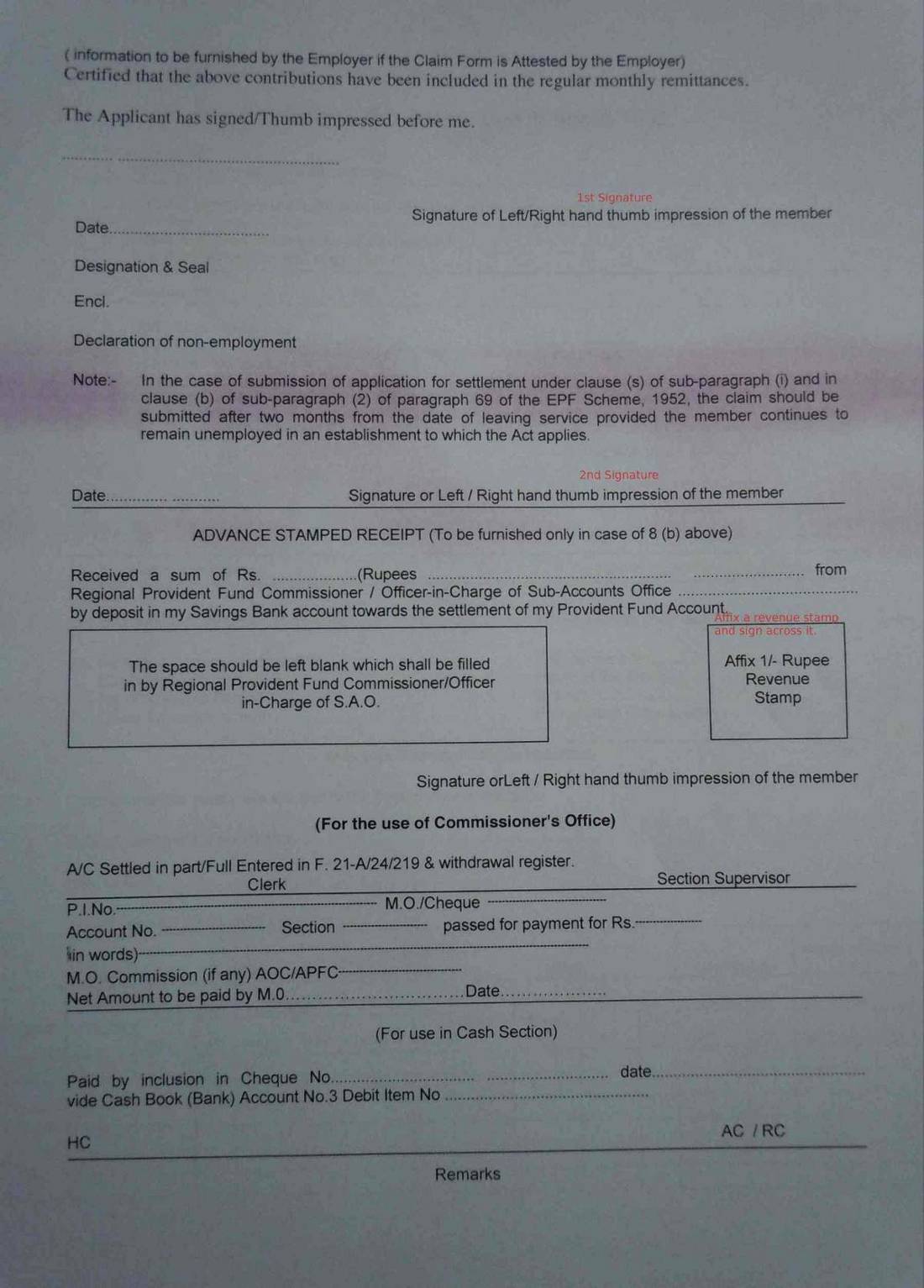

Form 19 Page 2

Please ensure to fill all the required fields in Form 19 correctly to avoid any rejection of claim. Below is a checklist of important entries -

-

Mobile Number - Fill in your mobile number at the top of the Form 19.

-

Name - Ensure that the name you fill in is exactly same as in your pay slips. Most claims get rejected because the name filled in the Form 19 differs from that in EPFO records. The name S. L. Goenka is different from Shyam Lal Goenka.

-

PF Account Number and UAN Number - Be very careful in filling out the PF number in right format. Any mistake and your claim will be rejected.

-

Address - This is the address where you will receive any communication from EPFO.

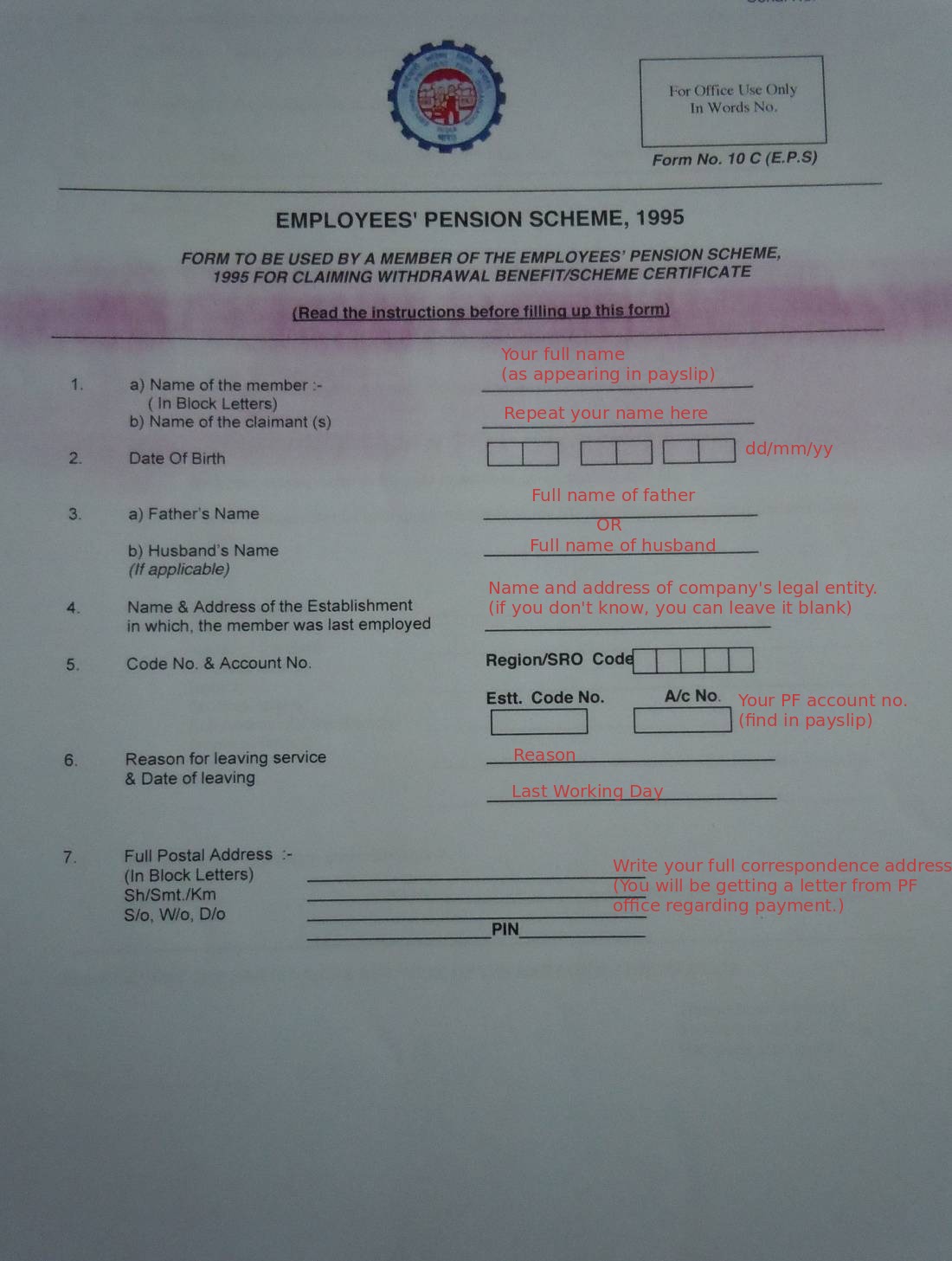

Instructions on how to fill Form 10c

I have put instructions in red against all the rows that need to be filled. Right click and open the below images in a new tab and then click for zoom.

Form 10c Page 1

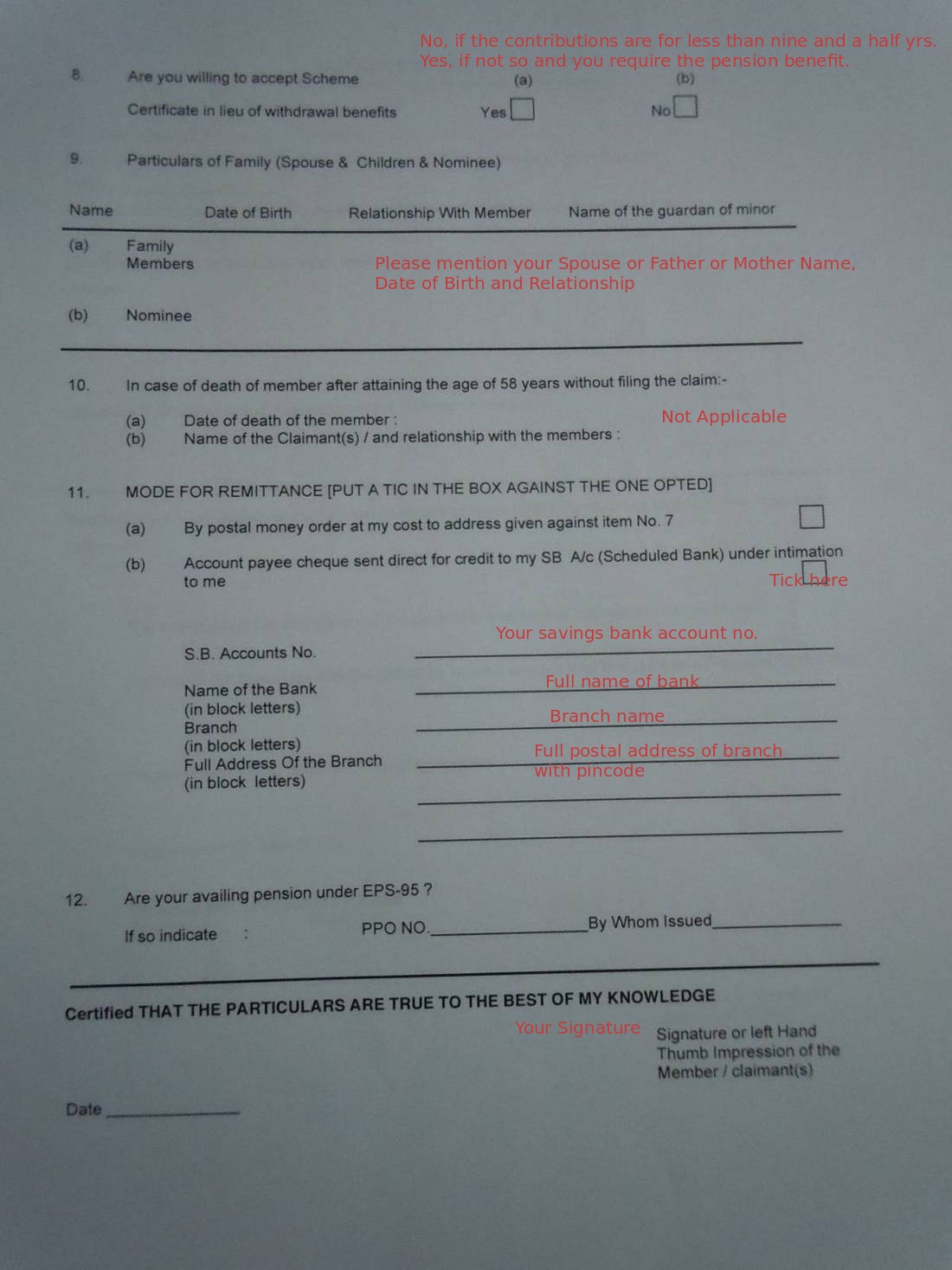

Form 10c Page 2

On page 3, you will have to affix a Revenue stamp and sign across it. Thats it. You need not fill any other details.

Download EPF withdrawal /PF withdrawal forms

Revenue Stamp availability in Bangalore

Post offices do not keep revenue stamps. I was able to get it from Koramangala BDA Complex for 5/- Rs. per 1 Re. stamp.

In Bangalore, affixing a revenue stamp is not required so companies in Bangalore accept the PF forms without it.

Know your claim status

Once your application is forwarded to the epf office by your employer, you can check your claim status on epfo website. You will also receive a sms from epfo stating that your application is received and is under process.

With all this information at your hand, I hope you would enjoy the process of submitting PF forms :)

Update: My PF money is transferred to my account electronically within a month of filing the claims.

To read all articles related to EPF/PF go to EPF/PF - All Articles