SBI UPI App SBI Pay - Step by Step Guide to Pay and Receive Money

State Bank of India has launched its UPI App (called SBI pay) on Nov 25, 2016. Currently 'SBI Pay' app is only available for android phone (ios version is blocked waiting specification from NPCI).

For people who are new to UPI, UPI stands for Unified Payment Interface and it is a new initiative from Government of India to make phone based money transactions easy and simple. Using UPI one can transfer money from/to directly from their bank accounts and does not require to keep money in e-wallet (where it does not earn any interest).

Please note that SBI UPI App (called SBI Pay) is a payment app not only for SBI bank customers, but customers of other bank can also use this app to send and receive money.

Install and Setup SBI UPI App (SBI Pay) in 3 Easy Steps

You can either search for 'SBI Pay' in your google playstore or you can go directly to SBI Pay link at playstore. You will need to perform the following steps only once.

Step 1: Mobile number verification

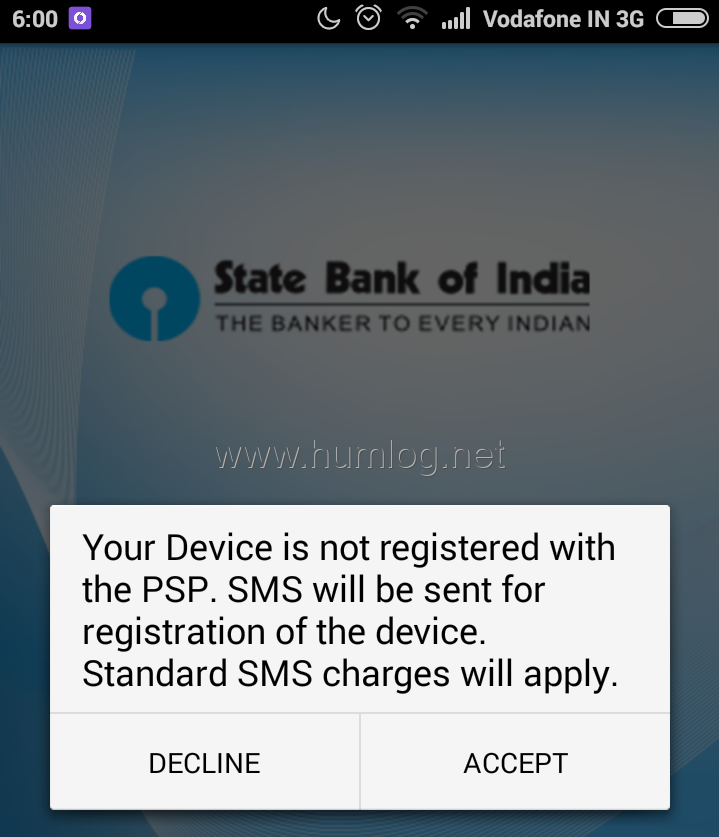

Once you install the app, it will automatically capture your mobile number. If your mobile number is not registered already, it will show you following messages:

"Your device is not registered with the PSP. SMS will be sent for registration of the device. Standard SMS charges will apply."

Before accepting, ensure that you have enough balance to let the app send an sms from your phone.Next, you will see another message -

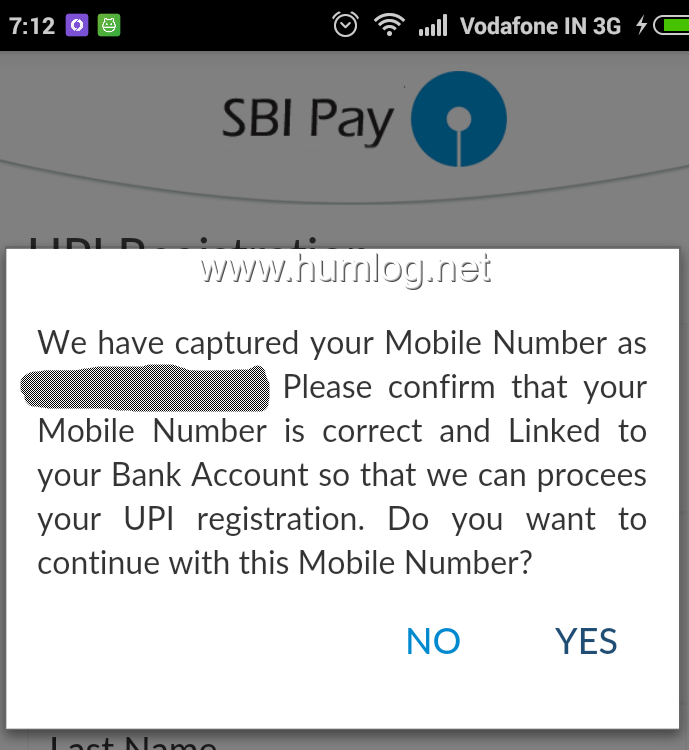

"We have captured your Mobile number as xxxxxxxxxxxx Please confirm that your mobile number is correct and linked to your bank account so that we can process your UPI registration. Do you want to continue with this Mobile number?"

Before clicking 'Yes', ensure that this mobile number is linked to your bank account (which you will use for transaction in SBI Pay app).Step 2: UPI Registration - Virtual Address creation and Bank Account Selection

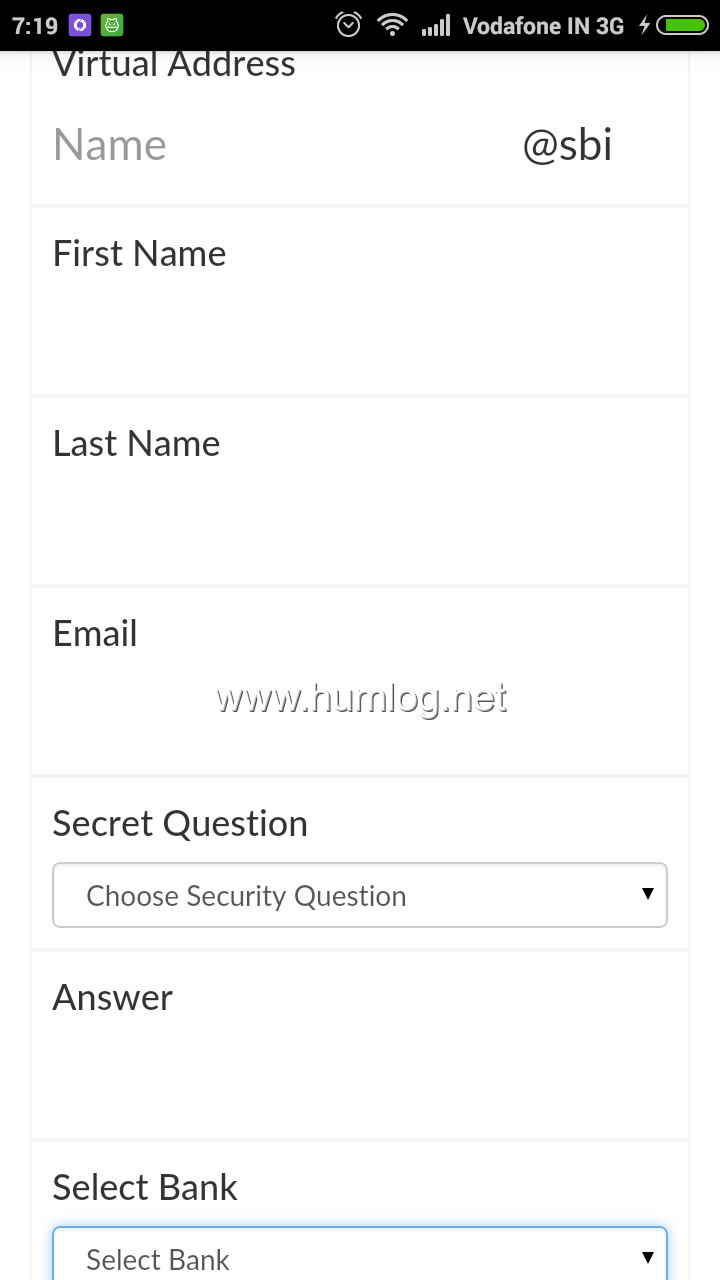

App will ask you to enter:

- Virtual Payment Address (VPA): You can choose any string as your virtual address. Typical example can be your name or your mobile number. If you choose say 'mohan', then your complete virtual address will be 'mohan@SBI'. Please note that if the given name is already taken, you will have to select another one (you can enter digits too)

- First Name, Last Name, Email, Secret Question & Answer and your bank name (from the drop-down).

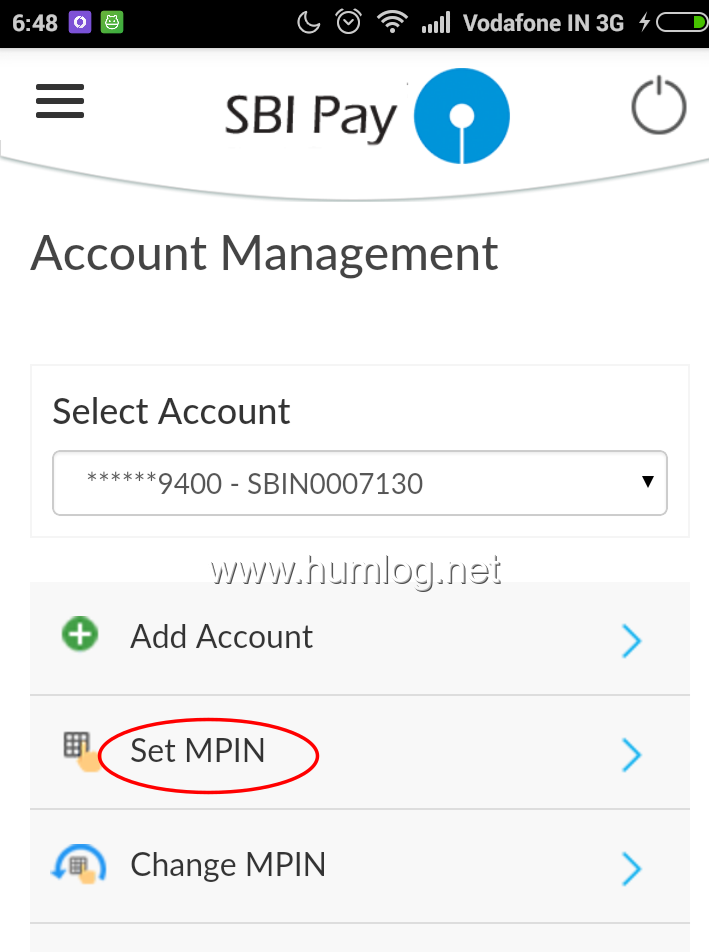

Step 3: Set MPIN for your Bank Account

To do any transactions on this app it is required to set a 6 digit MPIN. To set MPIN you have to:

- Click 'Set MPIN' in the 'Account Management' section.

- Select your bank account and then enter last 6 digits of your debit card and its expiry date.

- You will receive an OTP in your sms. Enter the OTP in the app and give your desired 6 digit MPIN. Make sure to remember your 6 digit MPIN.

How to Receive Money using SBI UPI App - SBI Pay

Once you have done your one time setup using above instructions, you are all set to receive money using UPI. To receive money, you have to give your virtual address to the sender. You don't have to do anything else.

The sender will have to install the UPI app on his/her mobile, do one time setup and can then send money to your virtual address. Sent money will be directly deposited in your bank account. Cool!! isn't it? :)

How to Pay or Send Money using SBI UPI App - SBI Pay

To send money to a person or merchant, you need to know their virtual payment address or virtual address. These address will be like 'mohan@SBI' or '849403922@SBI' and so on.

Once you know the virtual address of receiver, go to 'Pay' section in the app. Select your bank account, enter the receiver's virtual address in 'Payee Virtual Address' and receiver name in 'Payee Name' and the amount. Submit and then enter your MPIN. That's it. Money will be sent from your account to the receiver.

SBI UPI App launch Notes

As mentioned earlier, SBI has launched its app on Nov 25. On this occasion, following message was given by Arundhati Bhattacharya, chairman of SBI

“With the current demonetisation drive of the government and the push towards digital or cashless payments, SBI Pay is expected to be a game changer in the digital payment ecosystem as the bank has the largest customer base in the country,” - Arundhati Bhattacharya, chairman of SBI.